Your Portfolio Protected or Your Investment Returned*

SEC Registered | SIPC Insured

Invest like the top 0.1%

Automated Investing powered by AI

Backers and Partners†

Unless you’re in the top 1%, you can’t invest like the top 1%.

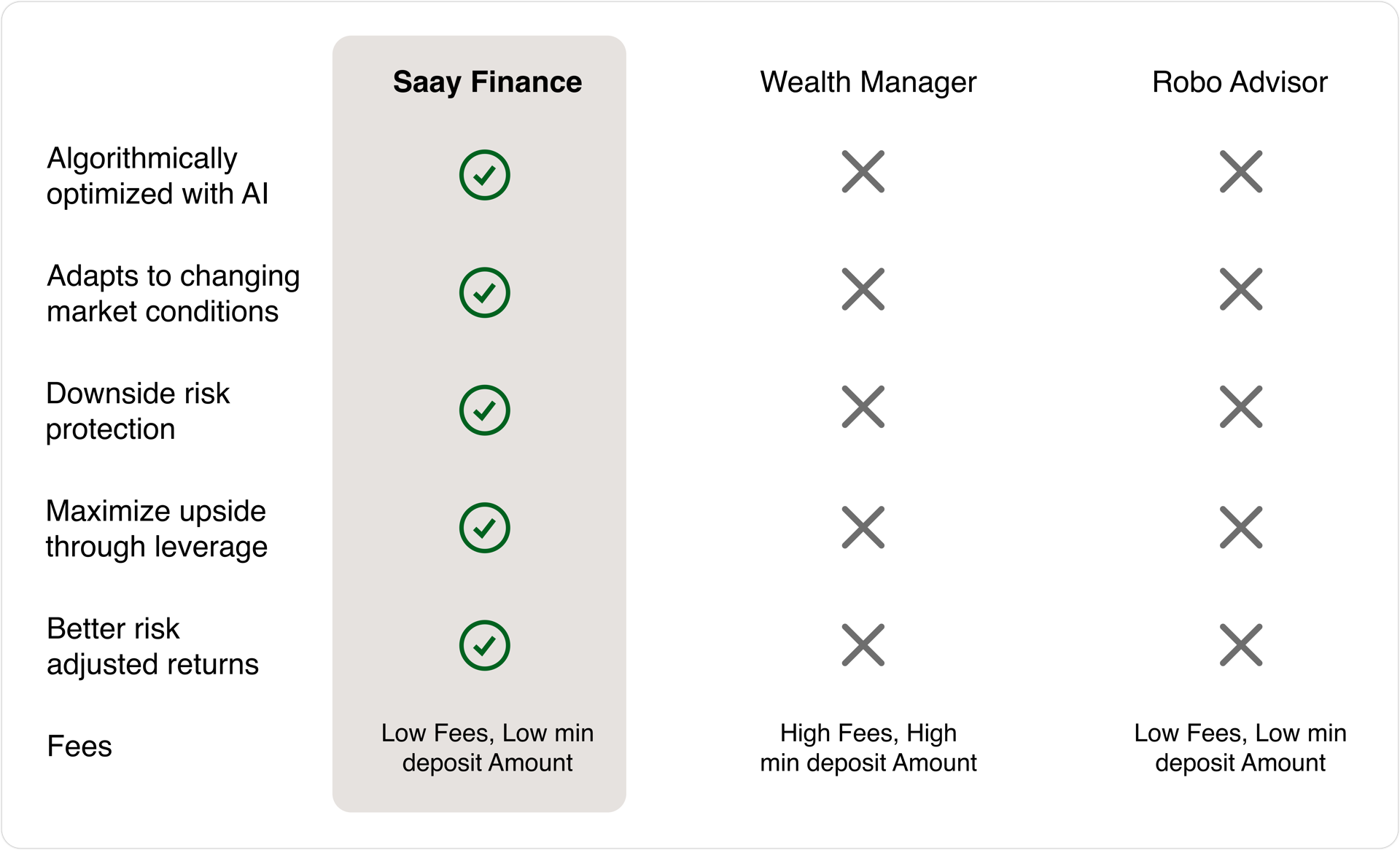

Hence you deserve a smarter option... Saay Finance allows you to invest intelligently to reduce losses and capture market gains.

They have their portfolios managed by firms which allows them to

You don't have the time, energy and coding skills to do endless hours of research to change your portfolio with changing market conditions.

Better risk-adjusted returns than any stock or ETF

Stress-Tested to the max!

Check how your Saay portfolio will hypothetically perform, in simulated future market crises and recoveries.

FAQ

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). While it does not imply a certain level of skill of training, such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client.

† The following is not intended to be construed as a testimony or approval of the services provided by Saay Finance.

An investment that has a better-risk adjusted return than any stock/ETF mean implies that the investment has achieved higher returns while taking on an equal or lower level of risk than the average returns of stocks or ETFs. This means that the investment has provided better returns for the same level of risk.

Investing in securities involves risk of loss and past performance does not guarantee future results. Any past returns, anticipated returns, or probability estimations are only hypothetical and might not correspond to the future performance.

For hypothetical future performance, we forward-test our models on 100,000 future scenarios generated using techniques like Monte Carlo. Note a hypothetical future performance is no guarantee of actual future performance. Furthermore, please note that the use of hypotheticals to make investment decisions can be limited by various factors, such as market conditions and individual circumstances, and should not be relied upon as the sole basis for making investment decisions.

*For the Growth portfolio, if your portfolio values stays 15% below your invested amount for consecutive 3 months, you can request for the return of your entire invested amount. For reference SPY was down over 45% in 2008 crisis, 30% during COVID and 20% in 2022 from its peak.