2022 Market Wrap - A Year in Review

Kartikay Goyle • 2023-01-07 • 3 mins

Year in Review 2022 - A look at everything that happened and affected the stock market.

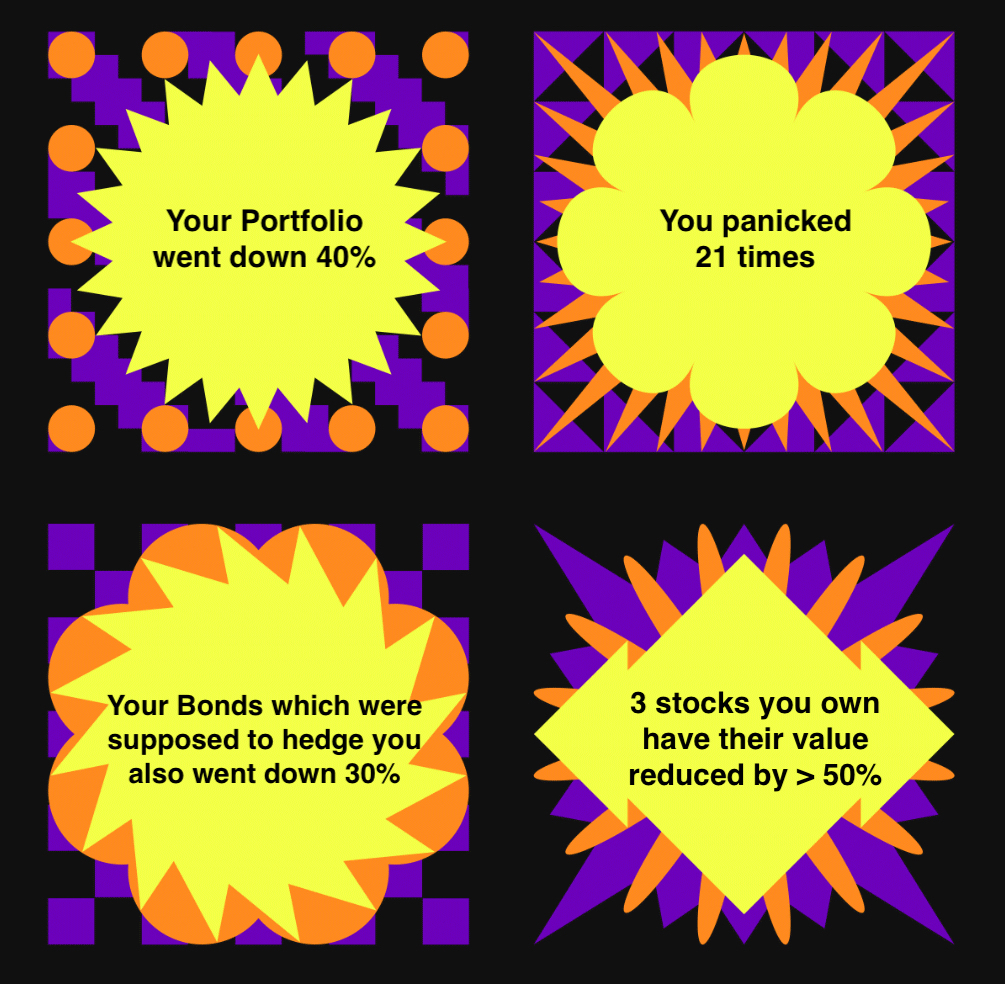

S&P 500: SPY was down by 20% and average stock in the S&P 500 has decreased by 15.7%. The top 5 stocks in the S&P 500 (Apple, Microsoft, Amazon, Alphabet, and Tesla) have decreased by an average of 28.6%. The total market value of the S&P 500 has been wiped off by almost $9 trillion this year.

Bonds: It was the worst-ever year on record for U.S. bond investors. Long term bonds like TLT went down by 30% as a result of fed hiking increase rate due to high inflation. In 2022, the overall bond index experienced a decline of over 13% - there has not been a double-digit decline in bonds since 1931.

Inflation and Interest Rate: The fed hiked the interest rate by 75 basis, the largest in 28 years. The year ended with fed hiking interest rate to 4.1% (up from 0.08%) in Jan to combat inflation which hit a 4 decade high at 9.2% YoY. The 2 year 10-year yield curve inverted for the first time since 2019 and saw its biggest inversion in about four decades.

Oil, Metals and Commodities: Ukraine-Russia war has had a major impact on prices of key commodities from oil and gas to steel and grains. DBO (Invesco DB Oil Fund) peaked by 141% but did a round trip gave away all its gains by year end. Fueled by war, most commodities did well - DBC which tracks broader commodity index was up 15% with wheat gaining 60% due to Russia and Ukraine being the leading wheat exporters.

Sector Performance: Energy sector outperformed all other sectors and was up 57% in 2022. The next best sector was utilities, which was up 2.5%. Technology sector had one of the worst performance with a resulting drop of 30%.

Housing: House prices went on a decline and fell over 35 percent with Mortgage rate surpassed 7% for the first time in 20 years.

U.S. Dollar: U.S. dollar strengthened against nearly every other major currency to levels not seen in decades. Euro declined, reaching parity (equal) with US dollar and eventually fell below parity for the first time in 20 years.

Unemployment rate: US unemployment rate reached the lowest point since 1968.

Crypto: The total market capitalization for the top 100 digital currencies dropped 70 percent, from $2.7T in November 2021 to $830B in November 2022. BTC and ETH both lost over 65% of their value from the year beginning. One of the most popular Stablecoin UST/Luna collapsed in June which setup a domino effect and led to further decline of crypto currencies and major exchanges, credit lenders and hedge-funds going bankrupt. Main players caught off in this crisis were Celsius, Voyager, Gemini, BlockFi, FTX, Genesis, Alameda and 3AC.

NFT: Several major hacks, rug pulls and wash-trading happened in this space. OpenSea the top NFT Marketplace had a trading volume of $4.8 billion which plummeted to $283 million by the year end - a staggering drop of 94%.

With a market this volatile and prone to various kinds of risks, use Saay Finance to safeguard yourself and be protected against economic risks and market downturns. Sign up for our waitlist here.

See More Posts

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). Such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client. Investing in securities always involves the risk of loss. Past performance does not guarantee future results.