BANKING CRISIS - PART 3 - Fall of Signature Bank

Kartikay Goyle • 2023-05-07 • 5 mins

This case study explores the fall of Signature Bank, examining the factors that led to its downfall and valuable insights learned from this event and why risk management is a crucial part for any financial institution.

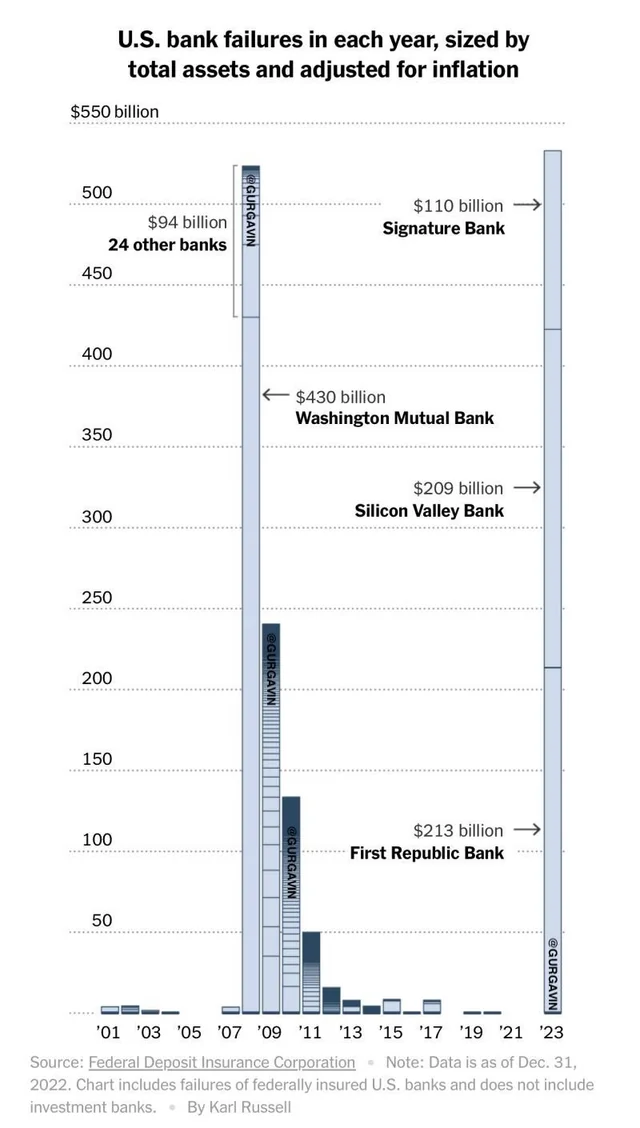

The collapse of Signature, a bank with less than $100 billion in assets, is a setback for various professional services companies that had grown to depend on it. In a way, Signature's downfall can be attributed to the anxiety that emerged around Silicon Valley Bank, which was taken over by regulators on March 10.

What services did Signature Bank provide?

Signature Bank had assets of less than $100 billion and was known for providing specialized banking services to law firms, such as holding client money in escrow accounts. It was founded in 1999 by Scott Shay, Joseph DePaolo, and John Tamberlane with support from Bank Hapoalim, Israel's largest lender. The bank went public in 2004. One of its specialties was financing the purchase of taxi medallions in New York and providing banking services to real estate companies and wealthy families. Some of its clients were linked to the Trump Organization, including Jared Kushner and his father Charles, and it helped finance Trump's Florida golf course. Although based in New York, Signature had expanded its business nationwide and on the West Coast. The bank's closure was a blow to the professional services firms that had come to rely on its specialized services.

What led to the collapse of Signature Bank?

With assets below $100 billion, Signature's closure is a significant loss for many professional services firms that relied on the institution. Its shutdown was likely due, in part, to the concerns sparked by the seizure of Silicon Valley Bank by regulators on March 10th. Signature Bank's specialization in real estate lending, as well as its recent attempt to attract cryptocurrency deposits, could not insulate it from the vulnerability that small and midsize banks face, particularly when they have a narrower customer base.

What happened to their customers?

Regulators assured that customers of Signature Bank were fully reimbursed, regardless of their account balance, after announcing the closure of Signature . However, panic ensued among Signature's customers, leading to a massive outflow of deposits, including those from small businesses. In addition to the plummeting value of its stock, the bank was unable to recover from the crisis. Nonetheless, Signature's leaders were confident that the situation was manageable, as the outflows had started decreasing. The bank's executives were stunned when regulators informed them of the bank's effective seizure, which included the removal of its executive team, despite their efforts to weather the storm.

And how did entering crypto deposits go for it?

Signature Bank, like Silicon Valley Bank, faced similar problems as most of its clients held deposits over $250,000. According to regulatory filings, nearly nine-tenths or over $79 billion of the bank's $88 billion in deposits were uninsured at the end of last year. Law firms, accounting firms, healthcare companies, manufacturers, and real estate management companies accounted for over 80% of Signature Bank's deposits . The bank also entered the business of accepting crypto asset deposits, with its digital asset-related client deposits amounting to $16.52 billion. However, the collapse of FTX and an ensuing criminal investigation led to the bottom falling out of crypto assets, which turned out to be a disastrous decision for Signature Bank.

Signature Bank's failure was largely due to weak risk management practices, including inadequate due diligence on high-risk clients and poor controls to manage these risks. They would imply mitigating downside risk by implementing more rigorous due diligence practices and stronger internal controls. This would involve conducting comprehensive background checks on potential clients, monitoring transactions for suspicious activity, and developing policies and procedures to manage risks associated with high-risk clients.

For investing with a focus on risk management signup for our waitlist at saay.finance/waitlist or read our blogs at saay.finance/blog.

See More Posts

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). Such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client. Investing in securities always involves the risk of loss. Past performance does not guarantee future results.