Can I use chatGPT for investing?

Kartikay Goyle • 2023-02-25 • 5 mins

Investing in the stock market can be a complex and challenging endeavor, but with the advent of artificial intelligence (AI), there are now more tools available than ever before to help investors make better decisions. One such tool is ChatGPT, a language model trained on a massive dataset of written text, which has an incredible capacity to understand and generate natural language.

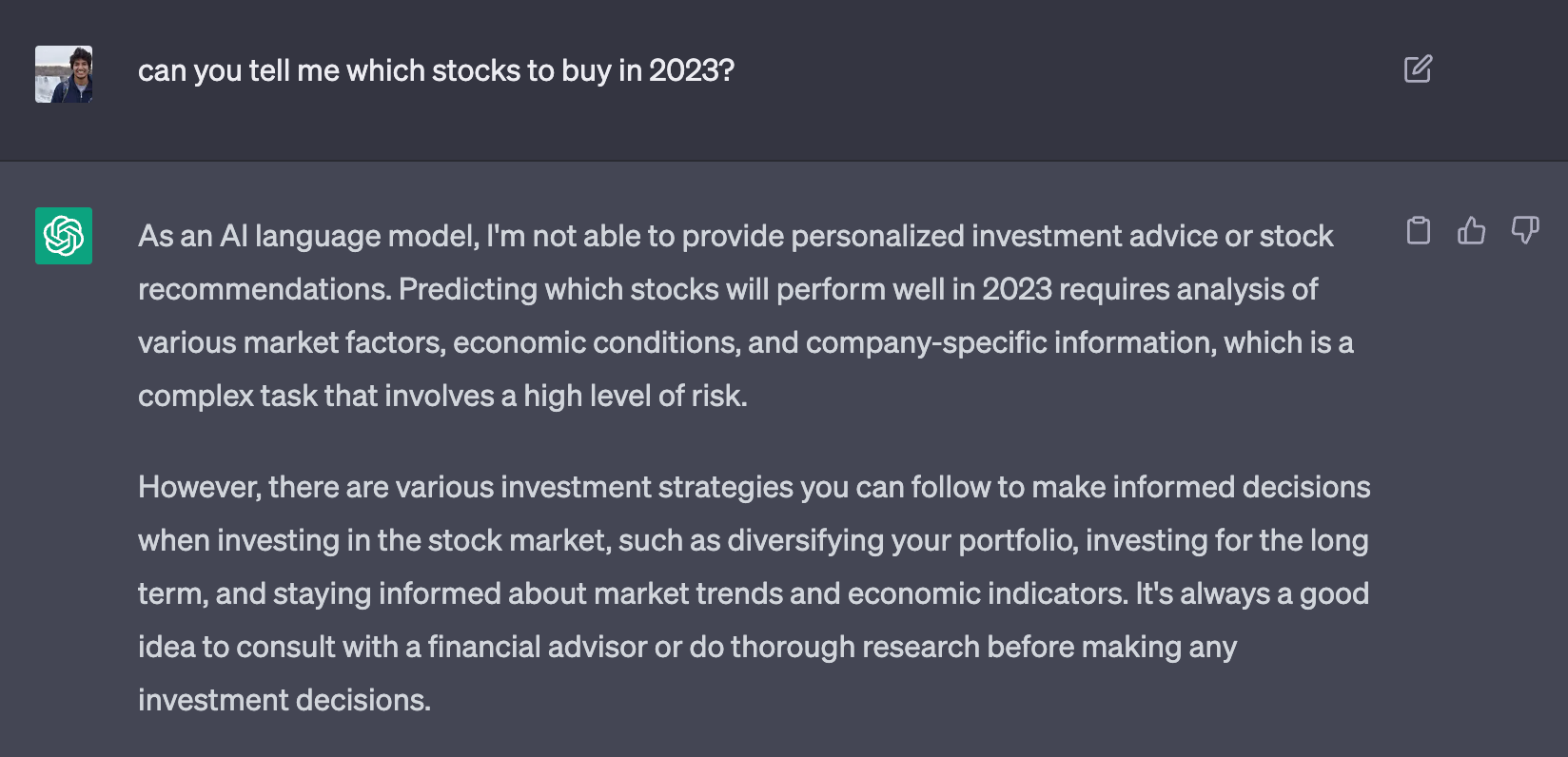

Let's first see what actually does happen when you ask ChatGPT for investing advice?

ChatGPT can answer a wide range of questions on various topics and provide insights on complex issues. However, when it comes to investing in the public market, ChatGPT is limited in its ability to help. While ChatGPT cannot directly provide you investment advice, it can however provide general information and insights on various aspects of investing in the public market, such as:

- Investment concepts and terminology: ChatGPT can explain investment concepts and terminology, such as stocks, bonds, mutual funds, dividends, and price-to-earnings ratios. For example, if you ask "What is a stock?" ChatGPT can provide a simple explanation, such as "A stock is a type of investment that represents ownership in a company."

- Market trends and news: ChatGPT can provide up-to-date information on market trends and news, such as changes in interest rates, inflation, or regulatory developments. For example, if you ask "What are the current market trends?", ChatGPT can provide insights into the overall direction of the market, such as "The market has been trending upwards in recent months due to strong earnings reports and positive economic data."

- Company-specific information: ChatGPT can provide information on specific companies, such as their financial performance, industry trends, and analyst ratings. For example, if you ask "What is the financial performance of Apple?", ChatGPT can provide a summary of the company's financial statements, such as revenue and earnings growth, profit margins, and cash flow.

- Investment strategies: ChatGPT can provide information on different investment strategies and approaches, such as value investing, growth investing, and index investing. For example, if you ask "What is value investing?", ChatGPT can explain the principles of value investing and provide examples of companies that are considered to be undervalued.

However, it is important to note that ChatGPT's responses are based on its understanding of the data it has been trained on and may not always be accurate or comprehensive. Some of the limitations for using chatGPT for investing include:

- ChatGPT is a language model and not designed for investment advice, so it lacks the expertise and experience to make sound investment decisions.

- ChatGPT's responses are generated based on patterns in large datasets, which can be influenced by biased or incomplete information.

- ChatGPT cannot account for market volatility, external events, or unforeseen circumstances that can affect stock performance.

- ChatGPT's responses are based on past data, but the stock market is constantly evolving, and historical trends may not necessarily predict future performance.

- ChatGPT cannot take into account individual investment goals, risk tolerance, and financial circumstances, which are important factors to consider when making investment decisions.

ChatGPT has the potential to revolutionize the way investors approach the stock market. With its ability to process vast amounts of data and provide personalized insights, it can save time and provide valuable insights to investors. However, it is important to keep in mind the limitations of using ChatGPT for investing, including its lack of expertise and experience, potential for biased or incomplete information, and inability to account for market volatility and unforeseen circumstances.

Overall, while ChatGPT can be a valuable tool for investors, it should be used in conjunction with other investment strategies. The future of AI in investing is bright, and Saay Finance is just one example of how technology can be used to make better investment decisions. Saay Finance uses AI and state-of-the-art algorithms to continually monitor various market factors, and based on changing market conditions, adjusts your portfolio to not only protect your downside, but also capture the upside. Investors interested in using AI to improve their investment strategy can sign up for Saay Finance's waitlist here.

See More Posts

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). Such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client. Investing in securities always involves the risk of loss. Past performance does not guarantee future results.