Does rising interest rates indicate an impending recession?

Kartikay Goyle • 2022-11-04 • 5 mins

With inflation at a four-decade high and Fed continously hiking interest rates, does that mean a recession is near?

Inflation is fundamentally caused by too much money chasing too few goods.

When demand runs too far ahead of supply, the economy begins to overheat, and prices rise sharply. To bring down surging inflation, the Fed raises interest rates to curb consumer demand. The resulting increase in borrowing costs can help slow economic activity by discouraging consumers and businesses from making new investments. This is the soft landing: Interest rates rise and demand falls enough to lower inflation, but the economy keeps growing.

But as per the World Economic Forum [1] recession is more likely - a shrinking, rather than growing, economy.

(Historically) We found that every time the Fed has hit the brakes hard enough to bring down inflation in a meaningful way, the economy has gone into recession. While some have argued that there have been several examples of soft landings over the last 60 years, including in 1965, 1984 and 1994, we show in our analysis that these periods had little resemblance to the current moment.

In all three episodes, the Fed was operating in an economy with significantly higher unemployment, lower inflation and lower wage growth. In these historical examples, the Fed also raised interest rates well above the inflation rate – unlike today, where inflation is at 8.5% and interest rates are projected to remain below 4% through 2023 – and explicitly acted early to preempt inflation from spiraling, rather than waiting for inflation to already be excessive.

The market is currently pricing in a peak fed funds rate of about 3.75% to 4.0% in early 2023 followed by a modest decline later in the year. In past cycles, the Fed has reversed course anywhere from three to 18 months from the peak. It only kept rates at peak levels for more than a year twice—in 1997-98 and in 2006-2007. In both those cases, the yield curve inverted—with short-term rates moving above long-term rates—just prior to the Fed cutting rates from peak levels.

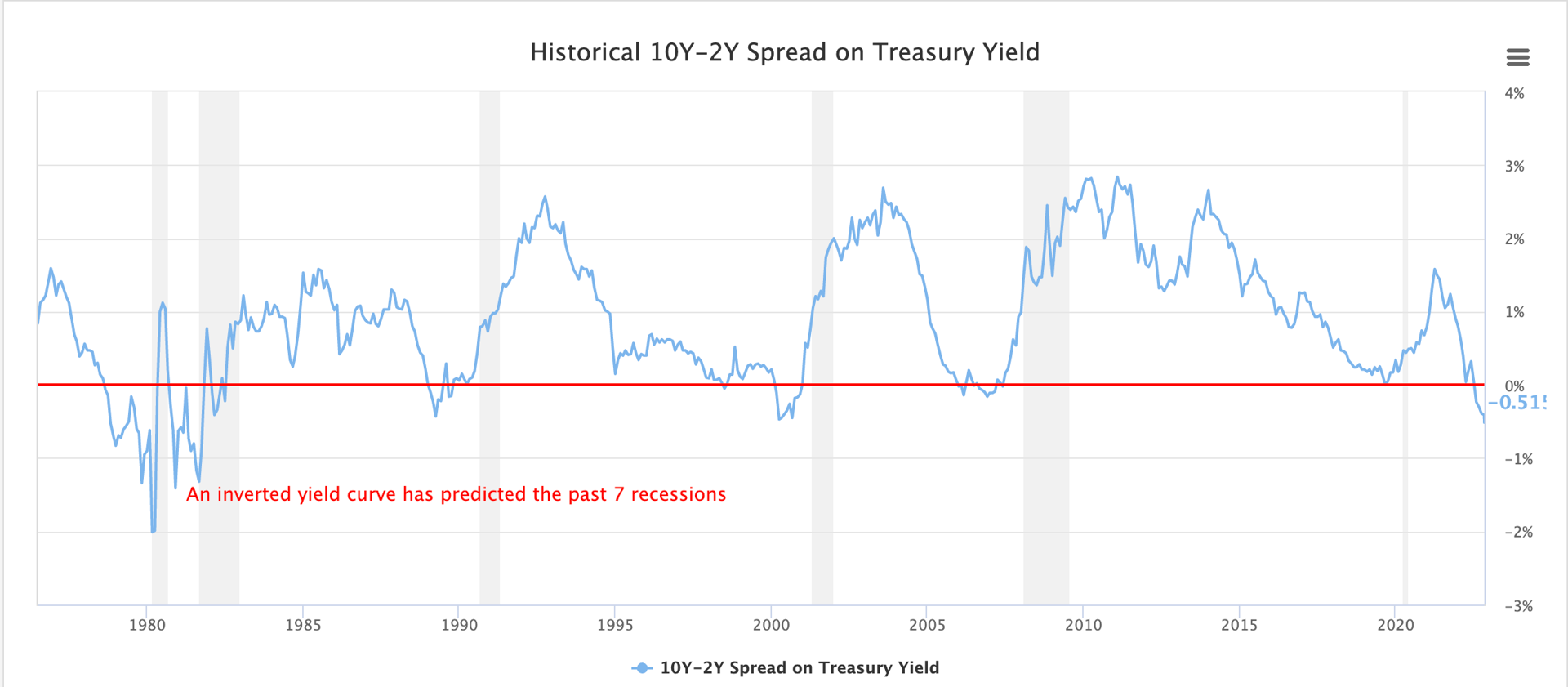

Historical 10Y-2Y Spread on Treasury Yield. Gurufocus

Inverted yield curve has anticipated each of the 10 U.S. recessions since 1955 (with just one false signal). A 10-year bond tends to yield more than a 2-year note usually, since there is more risk that inflation or higher interest rates will lower its market value before redemption. A yield curve inversion happens when short-term Treasury rates pay a higher interest rate than long-term Treasuries. As per MUFG Securities, the yield curve inverted 422 days ahead of the 2001 recession, 571 days ahead of the 2007-to-2009 recession and 163 days before the 2020 recession. At the time of the writing (Nov'22) we already have an inverted yield curve for much of 2022.

But is two-year versus 10-year Treasury yield spread really the right thing to look at? In a research paper published in June 2018, Fed economists Eric Engstrom and Steven Sharpe argued the so-called “near-term forward spread” - (differential between the three-month Treasury yield and what the market expects that yield to be in 18 months) has more predictive power for recessions than the more widely followed two-year versus 10-year Treasury yield spread. Even Fed Chair Powell indicated he considers the most important for forecasting recessions, the "Near-term Forward Spread". At the time of writing near-term forward yield spreads stood at around 25 basis points which is still positive. The Fed is walking on a tightrope of aggressively raising interest rates to bring down inflation without sending the U.S. economy into a deep recession. Regardless, one should have their portfolio setup to account for a high probability of recession in the next year.

If you want to stop worrying about changing market conditions you can safeguard yourself with Saay Finance which helps manage your investments and grow your returns in bear and bull markets alike. Sign up for waitlist here.v

Source:

[1] Fed hopes for ‘soft landing’ for the US economy, but history suggests it won’t be able to prevent a recession, https://www.weforum.org/agenda/2022/05/fed-soft-landing-us-economy-recession/

See More Posts

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). Such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client. Investing in securities always involves the risk of loss. Past performance does not guarantee future results.