Will investing like Warren Buffett make me rich?

Kartikay Goyle • 2022-11-01 • 3 mins

How does the Warren Buffet style of investing fare as of 2022?

Buffett follows the Benjamin Graham school of value investing. Value investors searches for stocks believed to be undervalued by the market, or stocks that are valuable but not recognized by the majority of other buyers by analyzing a company's fundamentals (Return on Equity, Debt/Equity, Profit margin etc.).

Through his company, Berkshire Hathaway (BRK), Buffett's largest holdings are Apple, American Express, Bank of America, and Coca-Cola

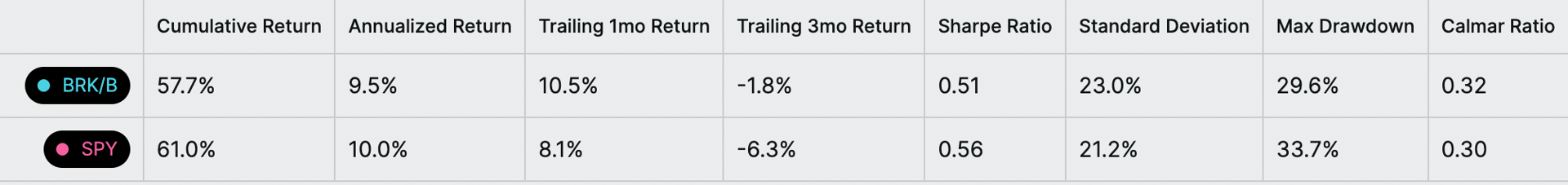

While it has managed to give comparable performance to SPY over a 5yr period, it still has not managed to beat it. If anything, Warren Buffett himself has extolled the virtues of index funds for average investors. That’s because Buffett, despite being one of the most successful stock pickers ever, doesn’t believe most active investment managers can beat the broader market.

5 yr return from 2017 1st Nov to 2022 1st Nov

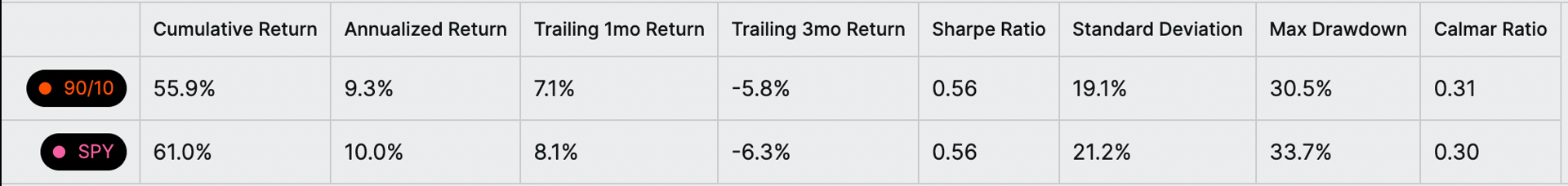

He even wrote in Berkshire’s 2014 annual shareholder letter that his advice for the trustee of his estate is to “put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund” for his wife. To quote Warren Buffett “I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers". So how well has the 90/10 portfolio fared over recent 5 years?

5 yr return from 2017 1st Nov to 2022 1st Nov

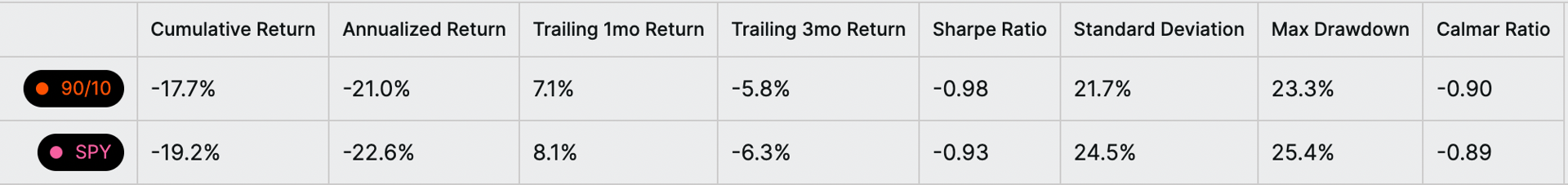

Again as one would expect, very comparable to index, since 90% of it is in allocated to index. 10% investing in bonds helps reduce the volatility but also ends up impacting the returns by a bit. However these strategies don't account for changing market conditions and economic risks including decade high inflation and interest rate hikes resulting in it being -18% YTD.

YTD returns as of 1st Nov to 2022

A Static Allocation relies heavily on a fixed asset allocation (90/10, 80/20) and does not dynamically change the percentage of these assets as the market conditions change.

Saay algorithmically determines the best asset allocation mix between equity, cash, commodities and bonds in portfolio to take advantage of market trends or economic conditions. Sign up for our waitlist here.

See More Posts

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). Such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client. Investing in securities always involves the risk of loss. Past performance does not guarantee future results.