What really defines a recession and are we heading towards one?

Kartikay Goyle • 2022-11-03 • 5 mins

What really defines recession and are we heading towards one?

As defined in investopedia, recession is a significant, widespread, and prolonged downturn in economic activity. A popular rule of thumb is that two consecutive quarters of decline in gross domestic product (GDP) constitute a recession. The National Bureau for Economic Research (NBER), an over 100-year-old nonprofit economic research institution, is the organization responsible for “dating” when a recession starts and stops.

Has negative GDP always led to recession? Mostly, it's rare to actually have two straight negative quarters without a recession designation at all. It apparently happened in 1947.

The United States economy grew an annualized 2.4% on quarter in the three months to September of 2022, rebounding from a contraction in the first half of the year, which saw the GDP shrink by 0.6% in Q2 and 1.6% in Q1. Two consecutive quarters of negative growth meets the common definition of a recession — though the NBER, didn’t officially declared one. So why was that case?

Well, the average lag between a turning point [a recession or a recovery] and the group's announcement is 12 month. The committee’s eight economists waited until December 2008 to declare that a recession had begun in late 2007. In the interim, Lehman Brothers had already gone bankrupt and the financial crisis was wreaking havoc around the world. The committee also takes its time in defining when a recession begins and ends, making sure to look at data on a broad timeline. The designations often come retroactively — which means the US could currently be in the middle of a recession without anyone officially recognizing it until after the fact. In fact, it’s taken NBER anywhere from 6 to 21 months in the past to determine economic peaks and troughs. So how do they make their decision?

The committee is supposed to take in a range of economic data including income, employment, consumer spending, retail sales and industrial production and then, looking backward, determine when there has been a “significant decline in economic activity that is spread across the economy and lasts more than a few months,” and be able to define contractions and expansions by identifying the peaks and troughs of the economy.

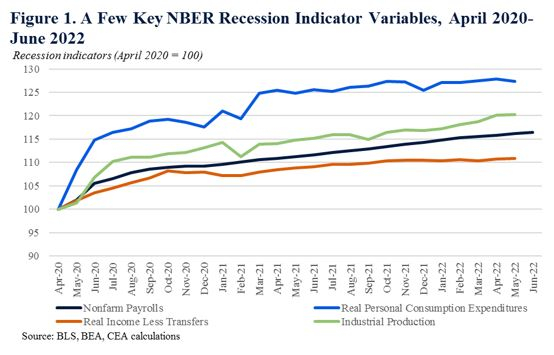

NBER Recession Indicator. Whitehouse.gov

As per the whitehouse.gov [1] website

[Above Figure] shows the trend in four of the NBER committee’s recession-indicator variables—real income minus transfers, real spending, industrial production, and employment—relative to their values in April 2020 (the trough of the last recession, and thus, the month before the current expansion began). All of these indicators have exhibited strong growth in the U.S. economy since the start of the pandemic, and have continued to expand through the first half of this year.

Unemployment and inflation are not factors directly considered by NBER for recession but we discuss them in more detail which you can read about here and here.

If you look at data, you can see why it's hard to predict. It’s all contributing to a very strange economic situation: Consumer prices are still rising, household spending is coming under pressure, and surging mortgages rates are starting to cool the housing market, even as unemployment sits at a five-decade low.

If you want to stop worrying about changing market conditions you can safeguard yourself with Saay Finance which helps manage your investments and grow your returns in bear and bull markets alike. Sign up for waitlist here.

Sources

[1] How Do Economists Determine Whether the Economy Is in a Recession?, https://www.whitehouse.gov/cea/written-materials/2022/07/21/how-do-economists-determine-whether-the-economy-is-in-a-recession/

See More Posts

Backed By

Saay, Inc. is an SEC-registered investment adviser (CRD # 323873/SEC#:801-127036). Such registration requires us to follow federal regulations that protect you, the investor. By law, we must provide investment advice that is in the best interest of our client. Investing in securities always involves the risk of loss. Past performance does not guarantee future results.